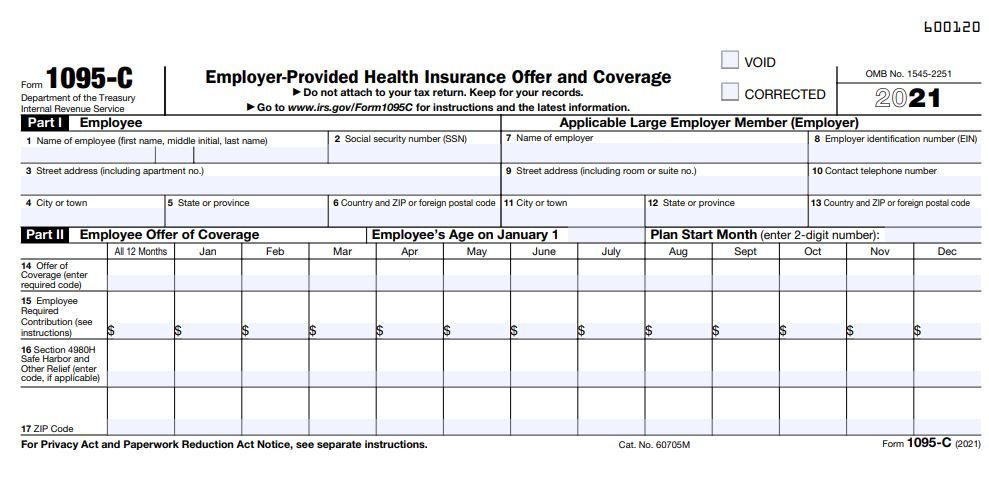

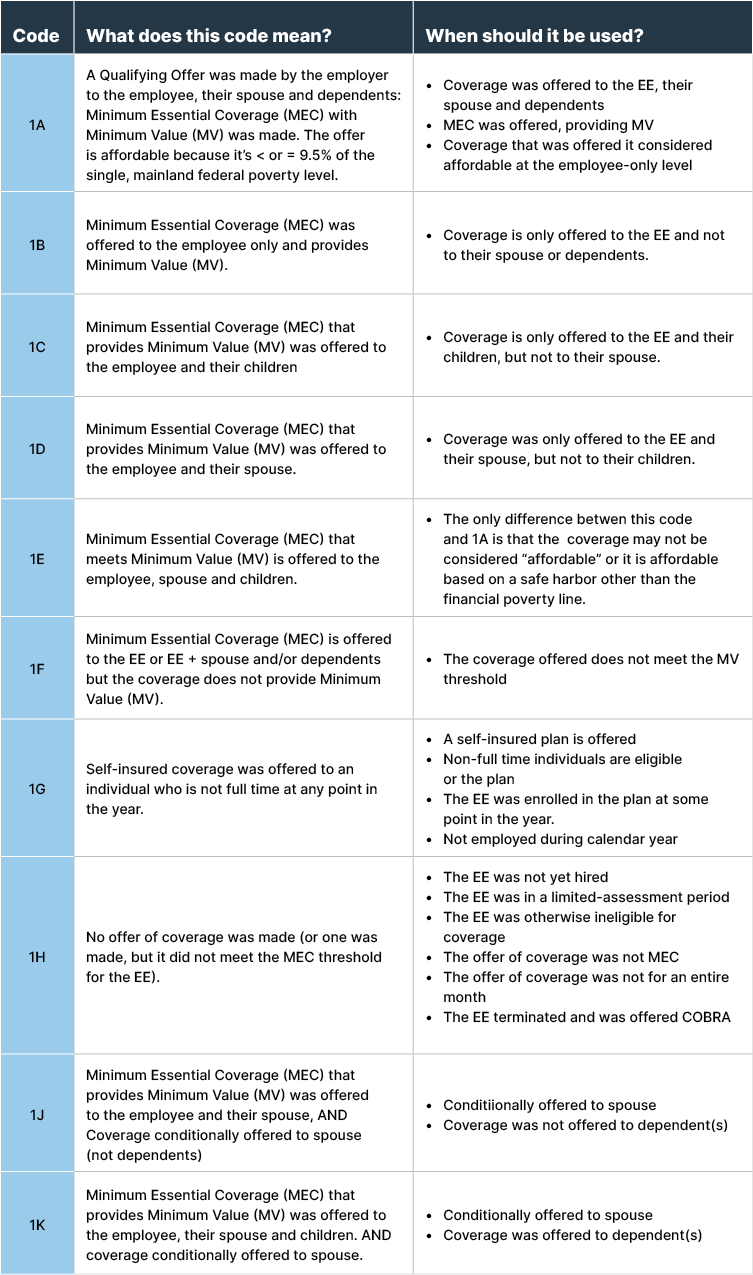

Form 1095-C: Line 14 – Code Series 1

The IRS has created two sets of Affordable Care Act (ACA) codes to provide employers with a consistent way to describe their medical benefit offerings to their employees. Each code indicates a different scenario regarding an offer of coverage, or explains why an employer should not be subject to a penalty for an employee, for each month.

Code Series 1 is used for Line 14 of Form 1095-C and addresses:

If an employee is benefit eligible in any month during the year, then line 14 should include a value for each month, even during months where an employee is not/no longer employed.

Important Note Regarding Affordability: References to affordability relate to affordability at the employee-only coverage level. It does not matter if the employee elects coverage for him or herself and a spouse or dependent. The IRS is only concerned with what the employee would have to pay if he or she elected coverage for him or herself alone.

*Offer of Coverage: An offer of coverage is one that provides coverage for every day of a calendar month. There is an exception for terminated employees who would have been covered for the entire month, if not for the termination.

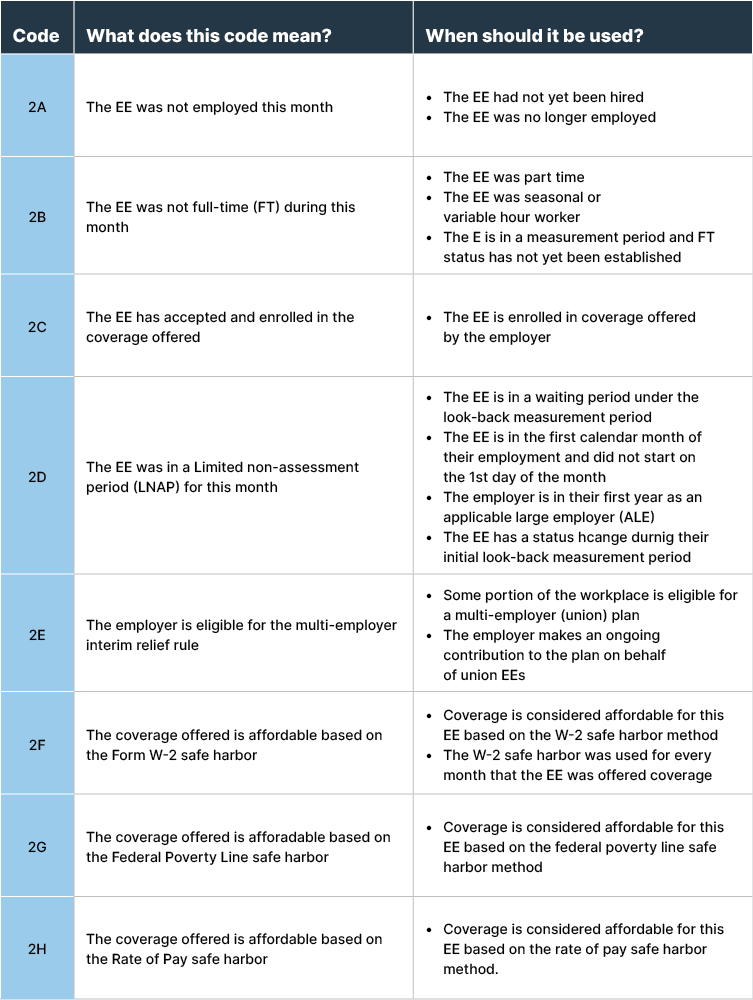

Code Series 2 is used for Line 16 for Form 1095-C and address:

Concerned about ACA compliance? Let us help you manage your data, effectively audit, and e-file to the IRS — with a click!

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own counsel.