In January 2016, the new standard about lease accounting IFRS 16 was issued and it introduced a few major changes. The most significant are:

I wrote an article highlighting these changes and illustrating them on examples some time ago, but you might want to check that out here.

In this article, I’d like to sum up the main requirements of the new IFRS 16 and you’ll find a video in the end.

The objective of the standard IFRS 16 Leases is to specify the rules for recognition, measurement, presentation and disclosure of leases.

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

But, why is there a new lease standard when we had an older IAS 17 Leases?

The main reason is that under IAS 17, lessees were still able to hide certain liabilities resulting from leases and simply not present them on the face of the financial statements.

I’m talking about operating leases, especially those with non-cancellable terms.

Under the new standard, lessees will need to show all the leases right in their statement of financial position instead of hiding them in the notes to the financial statements.

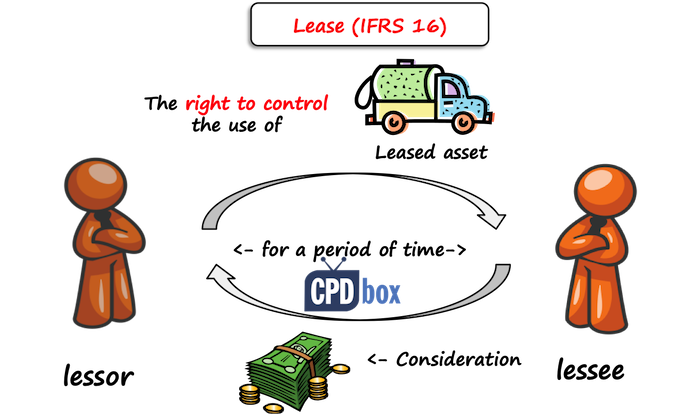

A contract is or contains a lease if it conveys the right to control the use of an identified asset for a period of time in exchange for consideration (IFRS16, par.9).

This definition of lease is much broader than under the old IAS 17 and you must assess all your contracts for potential lease elements.

You should carefully look at:

If the answer to these questions is YES, then it’s probable that your contract contains a lease.

As I wrote in my article about comparison of IFRS 16 and IAS 17, the impact of this new broader definition can be quite big, because some service contracts (with payments recognized directly in profit or loss) can now be considered as lease contracts (with necessity to recognize right-of-use asset and lease liability).

Under IFRS 16, you need to separate lease and non-lease components in the contract.

For example, if you rent a warehouse and rental payments include the fees for cleaning services, then you should separate these payments between the lease payments and service payments and account for these elements separately.

However, lessee can optionally choose not to separate these elements, but account for the whole contract as a lease (this applies for the whole class of assets).

Warning: Lessees do NOT classify the leases as finance or operating anymore!

Instead, lessees account for all the leases in the same way.

At lease commencement, a lessee accounts for two elements:

Let me outline the journal entries for you:

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

After commencement date, lessee needs to take care about both elements recognized initially:

Also, the lease payments are recognized as a reduction of the lease liability:

If you got this far in reading this article, maybe you find it overcomplicated, especially for “small” operating leases.

Here’s the good news:

You do NOT need to account for all leases like described above.

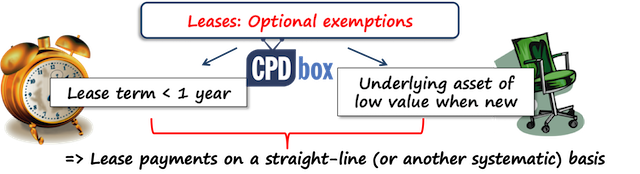

IFRS 16 permits two exemptions (IFRS 16, par. 5 and following):

So, if you enter into the contract for the lease of PC, or you rent a car for 4 months, then you don’t need to bother with accounting for the right-of-use asset and the lease liability.

You can simply account for all payments made directly in profit or loss on a straight-line (or other systematic) basis.

Nothing much changed in accounting for leases by lessors, so I guess you already are familiar with what follows.

Unlike lessees, lessors need to classify the lease first, before they start accounting.

There are 2 types of leases defined in IFRS 16:

IFRS 16 (IFRS 16, par. 63) outlines examples of situations that would normally lead to a lease being classified as a finance lease (and they are almost carbon copy from older IAS 17):

At the commencement of the lease term, lessor should recognize lease receivable in his statement of financial position. The amount of the receivable should be equal to the net investment in the lease.

Net investment in the lease equals to the payments not paid at the commencement date discounted to present value (exactly the same as described in lessee’s accounting) plus the initial direct costs.

The journal entry is as follows:

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

The lessor should recognize:

Finance income shall be recognized based on a pattern reflecting constant periodic rate of return on the lessor’s net investment in the lease.

IFRS 16 then also specifies accounting for manufacturer or dealer lessors.

Lessor keeps recognizing the leased asset in his statement of financial position.

Lease income from operating leases shall be recognized as an income on a straight-line basis over the lease term, unless another systematic basis is more appropriate.

Here you can see that the accounting for operating leases is asymmetrical: both lessees and lessors recognize an asset in their financial statements (it’s a bit controversial and there were huge debates around).

A sale and leaseback transaction involves the sale of an asset and the leasing the same asset back.

In this situation, a seller becomes a lessee and a buyer becomes a lessor. This is illustrated in the following scheme:

Accounting treatment of sale and leaseback transactions depends on the whether the transfer of an asset is a sale under IFRS 15 Revenue from contracts with customers.

IFRS 16 prescribes a number of disclosures in the notes to the financial statements.

I’d also like to point out that you have to apply IFRS 16 for the periods starting on or after 1 January 2019 (careful about the comparatives).

You can apply IFRS 16 earlier than that, but only if you apply IFRS 15 Revenue from Contracts with Customers, too (the reason is that these 2 standards are closely related).

Please check out IFRS 16 Leases in the following video:

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

81 / 190Very general question. Are you asking about premature termination? Are there any penalties involved? Are you asking as a lessor or as a lessee?

Wale Tilahun February 8, 2024 at 8:04 pmHey Silvia,

May you add one or more illustrations about service contract that will satisfy and considered as a lease?

e.g. acquisition of power service, accessing international network gateway (connections and data)?

Thanks

Hi, Thank you for making accounting standards much easier for us! Appreciate it. It would be great if you help me with the below question.

A company has leased lands from the government which expires in 2067.

The company had already invested and built residential apartments on the lands and they generate rental income for the company.

In 2019, the company adopted IFRS 16, and they accounted for the Right-of-Use (ROU) and lease liability based on future rental payments to the government.

Since the property satisfies the requirements for an investment property, the ROU and Building cost is accounted for under IAS 40, the investment property fair value model, which is permissible in IFRS 16.

The company revalues all of its investment properties every three years. Hence, in 2021, they revalued the lease land and building using an external valuer (valuation for land is done assuming that the lease will be continuously renewed upon expiry).

The difference between;

1. the ROU NBV (after deducting the amortization charge for 2019-2021) and land fair value, and

2. Building cost (not depreciated since IAS 40 fair value model) and fair value of the building,

is taken to P/L as revaluation gains in the year 2021. Now I have the below questions,

1. In the yearend of 2022, how should the company amortize its right of use for its lands, which is a revalued value? Or, shouldn’t the company amortize the land as it is classified under the FV model of IAS 40?

2. Starting from November 2022, the government has revised the rental payment for the lease. Now, I need to remeasure my liability for the new rental payments. Hence, how should I account for the difference between the lease liability as of Nov 2022 and the new remeasured lease liability? Thanks in advance

1. Amortization of Right-of-Use (ROU) for Revalued Land: # Since the land is classified as an investment property under the fair value model of IAS 40, the revalued amount of the land should not be amortized. In the fair value model, changes in the fair value of investment properties (including land) are recognized directly in profit or loss.

# Therefore, there is no need to amortize the revalued amount of the land. Instead, any changes in fair value will be recognized as revaluation gains or losses in the profit or loss statement. 2. Remeasurement of Lease Liability for Revised Rental Payments: When the government revises the rental payment for the lease starting from November 2022, you need to remeasure the lease liability to reflect the new terms. This adjustment is accounted for prospectively.

# The difference between the lease liability as of November 2022 and the new remeasured lease liability should be accounted for as an adjustment to the carrying amount of the right-of-use asset (ROU). This adjustment is recognized in profit or loss over the remaining lease term using the effective interest rate method.

# The accounting entries would involve updating the lease liability and the carrying amount of the ROU asset on the balance sheet. The interest expense on the new liability is recognized in profit or loss, and the principal portion of the payment reduces the lease liability while adjusting the carrying amount of the ROU asset. In summary, for the revalued land, there is no amortization, and any changes in fair value are directly recognized in profit or loss. For the revised lease payments, the difference in the lease liability is adjusted to the carrying amount of the ROU asset and recognized in profit or loss over the remaining lease term. Always ensure compliance with the specific requirements of IFRS 16 and IAS 40, and consider consulting with a professional accountant or financial advisor for detailed guidance tailored to your company’s circumstances.

Hi Silvia I have a very unique case when it comes to lease modification. The case is about a long term lease for 40 years has been modified by reducing the yearly payment to a very low amount lets say it was 50 then it went down to 20 this resulted in a very big reduction in the lease liability which was even higher than the right of use asset amount so if we go by the standard the asset amount will be negative so any thought about this peculiar situation because we are treating this change as a modification and not as new lease therefore we have to adjust the asset and the liability by the liability differential amount

Hi Silvia,

Thanks for the article

Question: We rent a building for 6 years with a total cost of CU 60 000, of which we paid 60,000.00 fully at the beginning of the lease contract, how can we measure it?