Lloyds is a traditional high street bank with branches in England and Wales, perhaps best known for its TV ads featuring galloping black horses. It is one of the leading UK-based financial services groups and in this blog post we’ll try to simplify and summarise Lloyds’ business banking options and help you to choose the business account that fits your needs. Because it can be tricky to work out how tariffs and charges work in the real world in your day-to-day business operations, we’ll also give an example of a sushi restaurant’s transaction activity and charges.

With ANNA you get a debit card, automated bookkeeping, a personal payment link, 1% cashback and 24/7 customer support

I agree to ANNA’s privacy policyLloyds has a range of different business accounts, each designed to support different stages and types of businesses:

| Business Banking Product | Who is it for? |

|---|---|

| Business current account for startups and small businesses | Startups and small businesses with an annual turnover of less than £3 million. |

| Business account for larger businesses | More established businesses with an annual turnover over £3 and less than £25 million. |

| Specialised business accounts | Business accounts tailored for schools, on-profit organisations and other establishments |

At ANNA we have 3 different packages: Pay as you go, Business and Big business, and none of them have a turnover limit. Find out more about ANNA business accounts.

To open a Lloyds business account you should be:

If you have an annual turnover of under £3 million and only one person needs to access the account, you can apply online, via the app or at the nearest branch. If your turnover is higher go straight to the nearest branch or call them at 0345 304 3546. They answer the calls from 9am to 5pm Monday to Friday, except on UK bank holidays. If you’re visiting the branch, make sure you checked the working hours on Google Maps.

You’ll need the following documents to hand:

We used prices valid from February 2024 as laid out in the Account Charges PDF and on the Business accounts page here for this report and this is what we found:

The first 12 months are free for business bank accounts, however after 12 months various fees kick in:

| Payment type | Fees |

|---|---|

| Introductory business account offer | Free for first 12 months |

| Monthly account fee | None for 12 months, then £8.50/month |

| Incoming local payments | Free |

| Outgoing local payments | First 100 a month are free / £0.20 each after that |

| Outgoing local payments | First 100 a month are free / £0.20 each after that |

| Cash payments (in or out) | £0.85 for every £100 at an Immediate Deposit Machine / £1.50 for every £100 over the counter |

| Cheques (in or out, any amount) | £0.85 at an Immediate Deposit Machine / £1 over the counter |

| Credit paid in at branch or ATM | £0.85 |

| Credit paid in at an Immediate Deposit Machine, Automated Deposit Machine, through the app | Free |

| BACS | File submission: £5.50 BACS Item: £0.15 (a set up fee may apply) |

| CHAPS | £30 |

Businesses with an annual turnover up to £25 million will get an international Visa debit card with the following functions:

At ANNA we don’t charge annual fees for our cards – you can have an unlimited number of cards on the Big Business plan and up to 5 free on the Business plan. With our Pay as you go plan you get charged just 20p per transaction which is equivalent to 42 transactions to match the Lloyd’s Business Account fee of £8.50/month.

| ANNA Business accounts | Free cards |

|---|---|

| Pay as you go | 1 card included, £3 per extra card, per month |

| Business | Up to 5 cards included, £3 per card, per month after that |

| Big Business | Unlimited free cards |

There are charges for payments to and from other countries, or in currencies other than sterling. These apply to all accounts that allow international payments. When sending money abroad and/or sending non-sterling currency within the UK each international payment via Internet banking costs £15; each international payment instructed in branch or by phone costs £21 and express international payments instructed in branch or by phone cost £28.

Note that the person you are seeing the money to (the payee) may also be charged a ‘correspondent banking fee’ on the payments, and depending on the location this might be £5, £12 or £20.

When receiving money from abroad and/or receiving non-sterling currency as electronic payments into your Lloyds business account, you’ll be charged £2 for up to £100 and £7 for payments over £100.

| International Business Banking | Fees |

|---|---|

| Sending money abroad via internet banking | £15 |

| Sending money abroad in branch or by phone | £21 |

| Express international payments instructed in branch or by phone | £28 |

At ANNA some of our packages include free international payments per month and there’s a flat fee of £5 per transfer after that.

| ANNA Business Accounts | Free SWIFT payments per month |

|---|---|

| Pay as you go | None, £5 per payment |

| Business | 1 free SWIFT payment, £5 per payment after |

| Big Business | 4 free SWIFT payments/month, £5 per payment after |

Payments made online into the Lloyds business bank account are free. For online payments out, the first 100 a month are free then it’s £0.20 for each electronic payment after that.

| Local transfers in Lloyds | Fee |

|---|---|

| Electronic payments in | Free |

| Electronic payments out | 100/month free, then £0.20 for each electronic payment after that |

At ANNA you have unlimited free bank transfers on the Big business plan, 50 free bank transfers on the Business plan, while on Pay as you go, we charge 20p per bank transfer.

| ANNA Business Accounts | Local free bank transfers |

|---|---|

| Pay as you go | 20p per bank transfer |

| Business | 50 free bank transfers, 20p per transfer after that |

| Big Business | Unlimited free bank transfers |

Cash payments (in or out): £0.85 for every £100 at an Immediate Deposit Machine / £1.50 for every £100 at Branch counter, ATM, depositpoint™, Nightsafe, Post Office® or other third-party deposit method

At ANNA you pay no commission fee on the Big business plan. On the Business plan you get £300 cash per month for free and 1% commission after that. On Pay as you go you pay 1% commission.

| ANNA Business Accounts | Local free bank transfers |

|---|---|

| Pay as you go | 1% of the cash value deposited |

| Business | £300 cash per month for free and 1% commission after that |

| Big Business | Unlimited deposits with no commission |

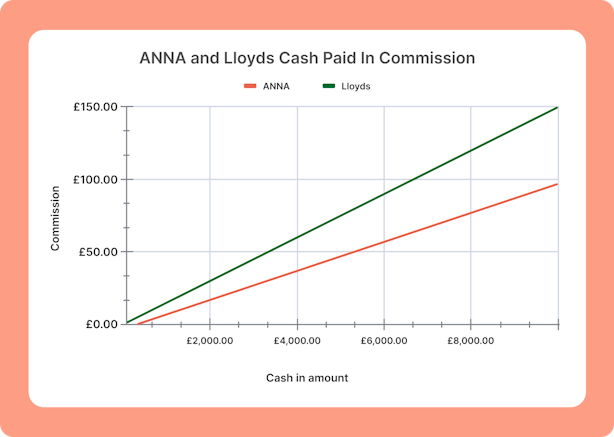

If you have a cash-heavy business, commission fees on cash being paid into your business bank account could be crucial when it comes to deciding who to bank with. Here’s a graph showing the difference in charges between ANNA and Lloyds, based on the amount of money cashed in. We compare ANNA’s Business package – which allows you to cash in up to £300 for free and charges 1% after that – with Lloyds, which charges £1.50 per £100 cashed in over the counter, ATM, depositpoint™, Nightsafe, Post Office® or other third-party deposit method.

As you can see, the more cash you pay in the more beneficial it is to use ANNA rather than Lloyds. If you were cashing in £2,000 you’d pay £30 in commission at Lloyds, while at ANNA it’s just £17 – nearly half as much.

Cash machine withdrawals at Lloyds’ cashpoints and other banks’ ATMs are free.

At ANNA we offer unlimited free ATM withdrawals on our Big Business plan. On the Business plan you get 3 free cash machine withdrawals per month and it’s £1 per withdrawal after that. On Pay as you go, it’s £1 per cash machine withdrawal.

| ANNA Business Accounts | ATM withdrawal fees |

|---|---|

| Pay as you go | £1 per ATM withdrawal |

| Business | 3 free ATM withdrawals per month, £1 per withdrawal after |

| Big Business | Unlimited free ATM withdrawals |

Yes, you can deposit a cheque using the Business Mobile Banking App (this costs 80p) as well as at the counter or using a self-service machine in the branch (£1/cheque). You will be charged £1 for every outgoing cheque being cashed.

| Cheque pay in option | Fee |

|---|---|

| Cheque paid in using the app | 85p per cheque |

| Cheque paid in via Branch counter, ATM, depositpoint™, Nightsafe, Post Office® or other third-party deposit method | £1 per cheque |

| Cheque paid out of the account | £1 per cheque |

Currently ANNA has no option to deposit cheques to the account, but we’ll be introducing this feature in the future.

Yes, you can apply for a LLoyds business account online via the app, which you’ll need to download. You can apply if:

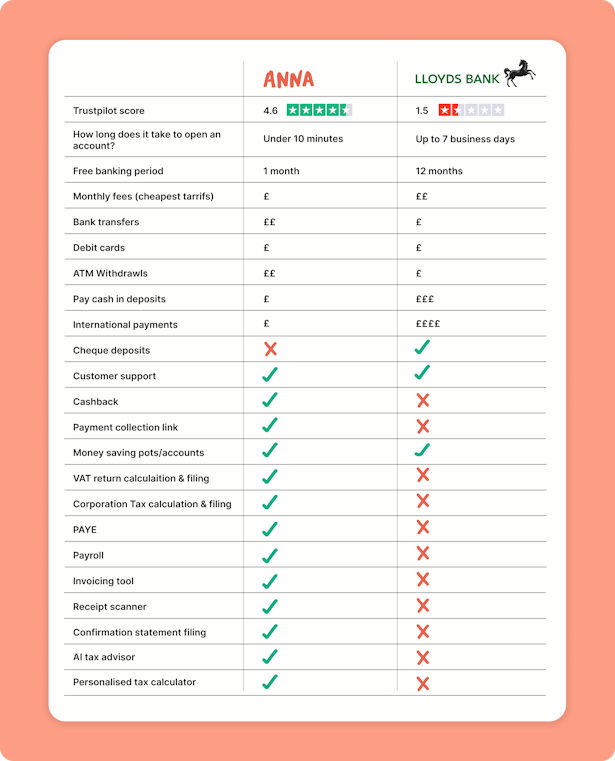

It takes on average 3 to 7 working days to open a Lloyds business account, while at ANNA you can open a business account online in under 10 minutes.

Head to the Lloyds website and click through to Help & Support, then Account Management then Close An Account. Here you can ask Lloyds to close an account by completing the Account Closure form.You can always apply for an ANNA business account instead.

To give you some context of how these two accounts measure up, we’ve created a fictional case study – Sui’s Sushi in London’s Notting Hill, and imagined what a typical month might look like…

Tom manages our hypothetical Sui’s Sushi restaurant. Last month he:

With Lloyds business account he would have to pay:

£8.50 (lowest tariff after 12 months) + 1x£15 (outgoing payment to China) + 8x£1.5 (for cash in) + 78x£0 (for local transactions, card payments) = £35.50

With ANNA he’d pay: £14.90 + 50x£0 + 28x£0.2 (for 78 local transactions, given they choose Business package they have 50 free transactions, and 20p for the rest) + 1x£0 (for international payment included in £14.90 package) + £5 (for cash in) = £25.50.

To sum up, Tom would save £10 with ANNA over the month, which is £120 annually. But, most importantly, ANNA would help him to save lots more on accounting software.

For just £3 a month he’d be able to try the ANNA + Taxes add-on, which fully automates tax calculation and filing: VAT, Corporation Tax, Payroll and Confirmation statement. On top of that, he could create, send and even auto-chase invoices, scan receipts and collect payments with one single app.

Opening a business bank account at the high street bank is a solid, safe option. But it’s not going to be fast or easy to set up a business account with Lloyds, so prepare yourself for it to take a few days and a bit of legwork.

Even after the onboarding bit is sorted, based on Lloyds’ Trustpilot reviews, it’s best to manage your expectations about the customer service. If you have any problems you’ll have to call the customer phone line (an unbearable thought for a millennial!) and you’ll probably be stuck on hold for long enough to get a very unpleasant ear worm.

On the other hand, you can always diversify your risks and have several business bank accounts so there’s never any disruptions or issues due to having all your money in a single account. With ANNA you can open a digital business account in under 10 minutes, and enjoy the speedy service and smooth, intuitive chat functions. The first month of ANNA is also free, so you can play around with tools like invoice creation, receipt scanner, payment link and lots more, to help you save time and money as you grow your business.

Open a business account with ANNAANNA business account comes with a handy app, an expense card and your personal payment link to accept payments online